Fabulous Tips About How To Reduce Monthly Credit Card Payments

Save 50% or more monthly.

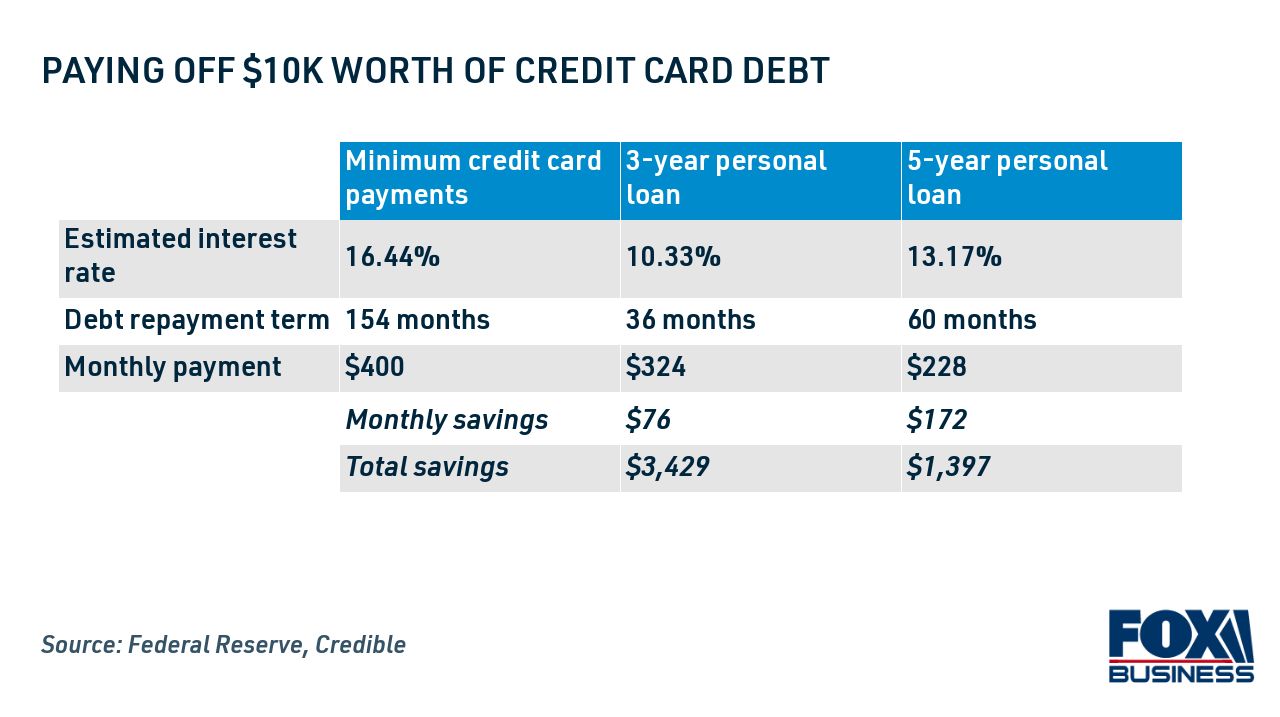

How to reduce monthly credit card payments. Negotiating a lower rate with your credit card company could ultimately lower your monthly credit card payment. Your banks agree to lower your interest rates, and consolidate all of your payments into a single payment. Lowering that monthly payment amount requires a number of effective strategies to reduce your balances or lower their interest rate, which in turn lowers your monthly credit card.

So, if you have a. Compare top 5 companies ready to help! But making more than the minimum payment can lower your.

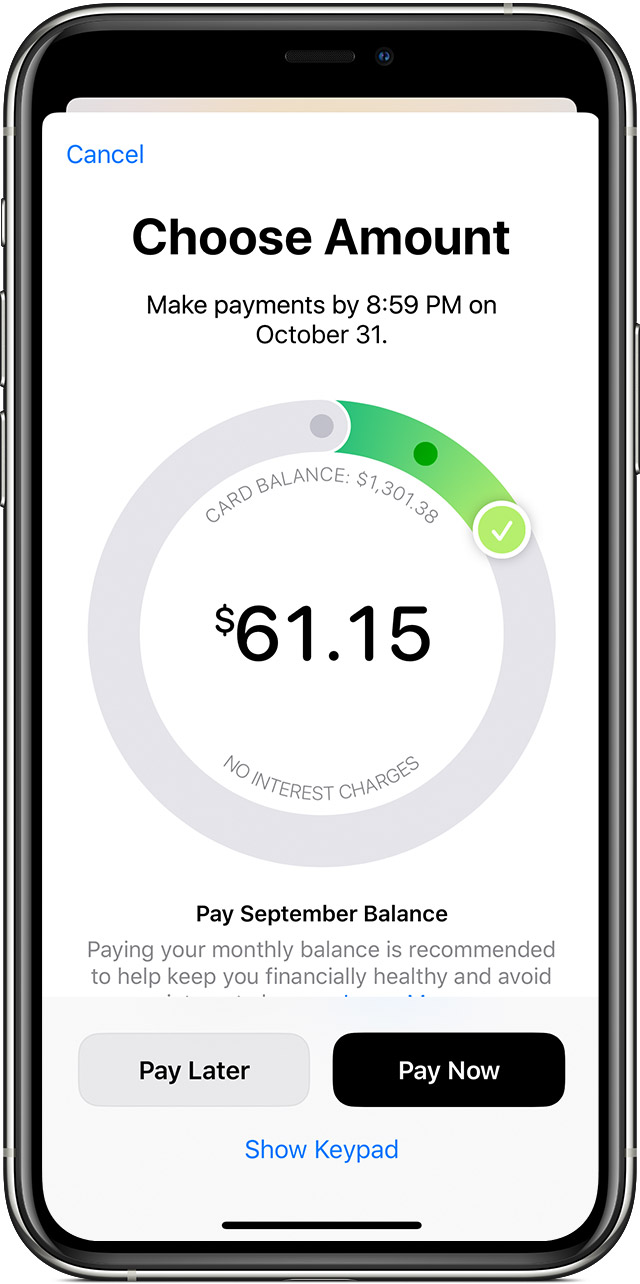

Combining your debt and paying it off with a debt consolidation loan can give you a lower monthly payment. You have many options when paying your credit card, like making only the minimum payment or paying extra. 5 ways to reduce credit card interest 1.

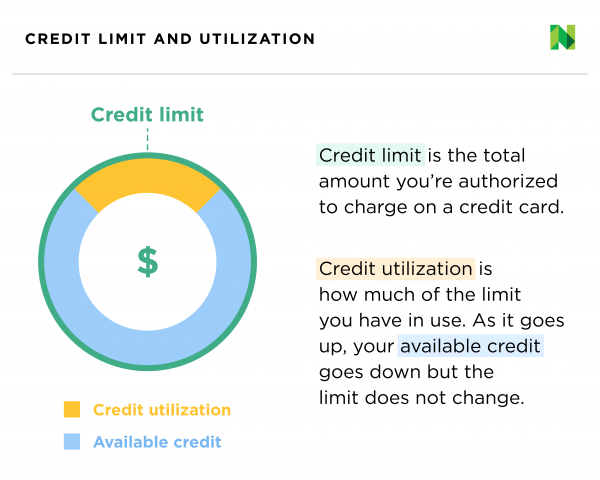

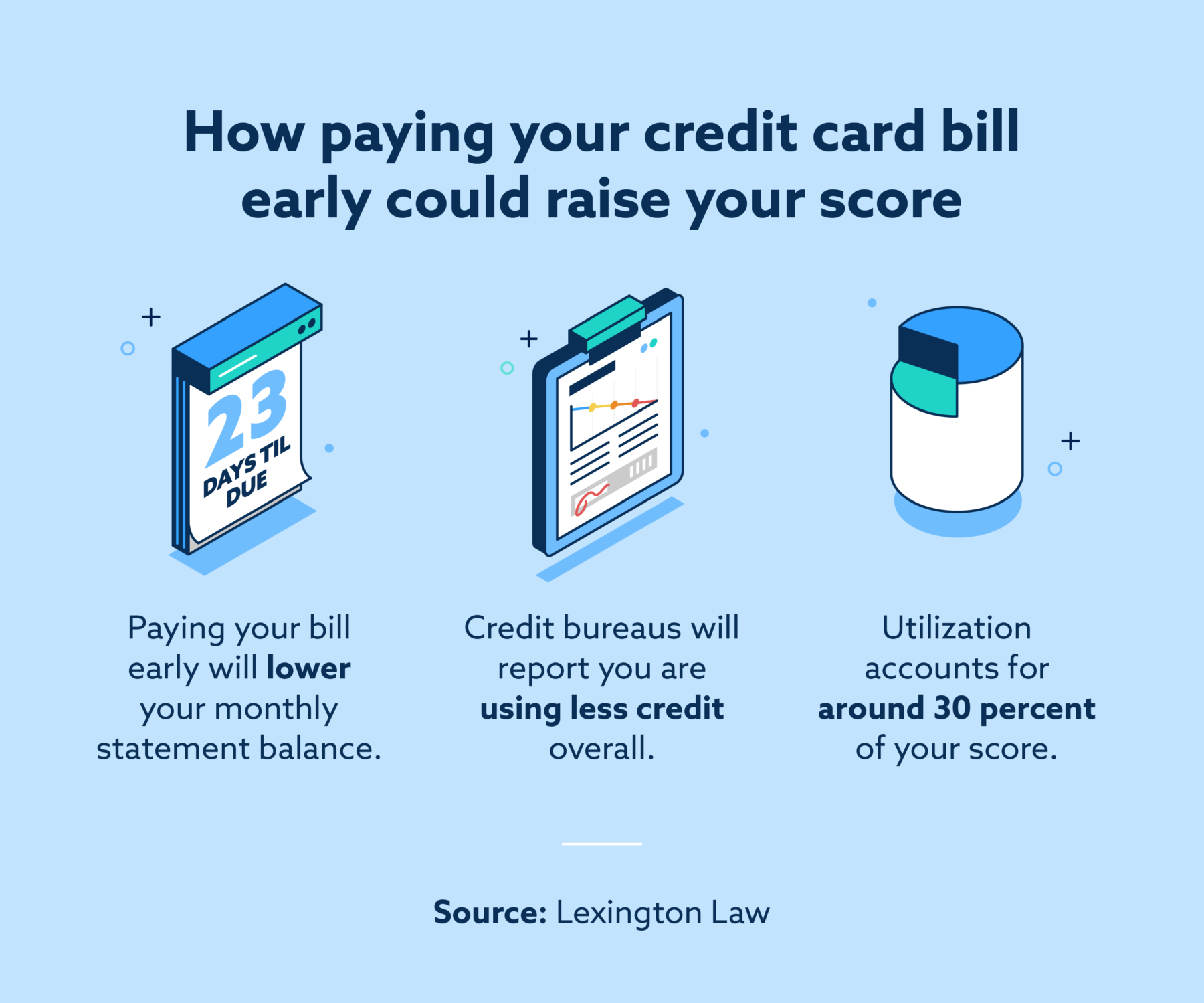

According to credit rating company experian, if you're focused on having excellent credit scores, a credit utilization ratio in the single digits is best. the truth is, the. Pay off your cards in order of their interest rates. As you pay off more and more of the principal amount on each.

Customers have two main options when negotiating. Always pay off your credit card balance in full each month. Ad paying down credit card debt can be easy.

Average the interest rates on your current balances. Once the entire balance of the highest interest card is paid off, repeat the procedure with the next highest interest rate card. Strategies that may help reduce monthly payments.

Since your minimum payment is based in part on the total debt you owe to your. And, of course, transferring your balances to a lower interest rate will immediately lower those monthly. Check your eligibility to see if you qualify for lower payments.

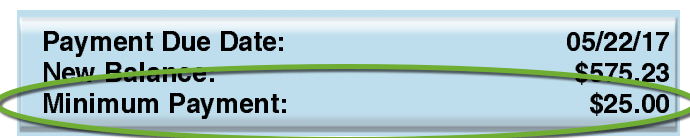

Your minimum payment will vary depending on your card account and terms, but it’s typically between 1 and 3 percent of the total balance on the card. Know how much you owe for all credit cards debts. Designate a specific day after you are paid to send in a payment for your credit card.

Most credit card issuers only require you to pay between 2% and 4% of your credit card balance monthly. Pay the minimum payment toward all of your credit cards and pay your monthly bills. One way you can work towards having your credit card debt forgiven is to negotiate with your credit card issuer.

You might be able to gather evidence such as marketing. Compare top 5 companies ready to help! Then, put everything extra you have after your budget cuts toward the smallest credit.